Prediction Markets vs Traditional Betting: Key Differences Explained

Quick Answer

Prediction markets allow users to trade shares representing event outcomes, with prices reflecting probabilities. Traditional betting involves wagering against a bookmaker at fixed odds.

Key differences: prediction markets provide peer-to-peer trading, transparent pricing, a wider range of events, and often better odds. Traditional betting offers instant settlement, familiar interfaces, and established regulatory protections.

Introduction

Are you trying to decide between prediction markets and traditional sportsbooks? Both let you wager on the future, but the mechanics, risks, and potential rewards are very different.

This guide breaks down every major difference, helping you choose the platform that aligns with your goals, experience level, and preferred types of events.

What Are Prediction Markets vs Traditional Betting?

Understanding the fundamental differences starts with how each system operates. While both allow you to wager on future events, the underlying mechanics, market structures, and user experiences are completely different.

Traditional Betting (Sportsbooks/Bookmakers)

Traditional betting means placing wagers with a bookmaker. You bet against the house at odds they set.

How It Works:

-

Bookmaker sets odds based on expert analysis and desired profit margin

-

You place a bet at these fixed odds

-

If you win, the bookmaker pays you; if you lose, they keep your money

-

Profit comes from the "vig" or built-in house edge

Example: Bet $100 on Team A at +150 odds. If Team A wins, you receive $250 ($150 profit + $100 stake). If they lose, you lose $100.

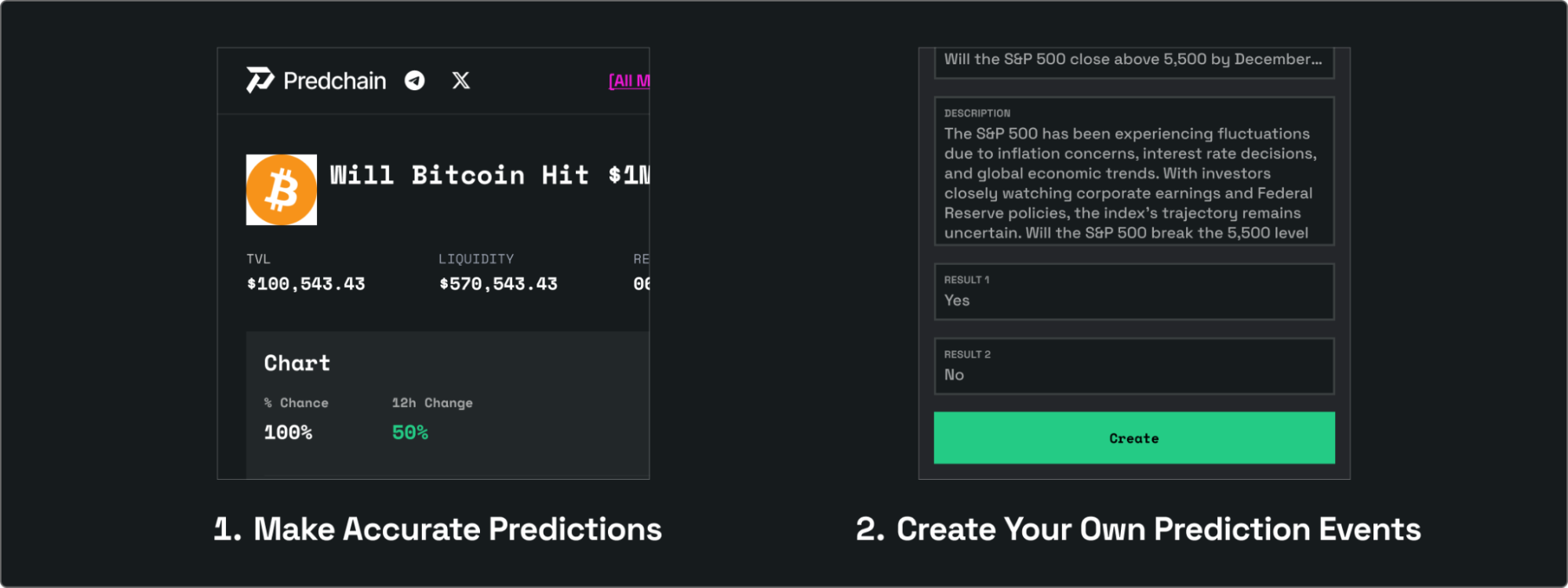

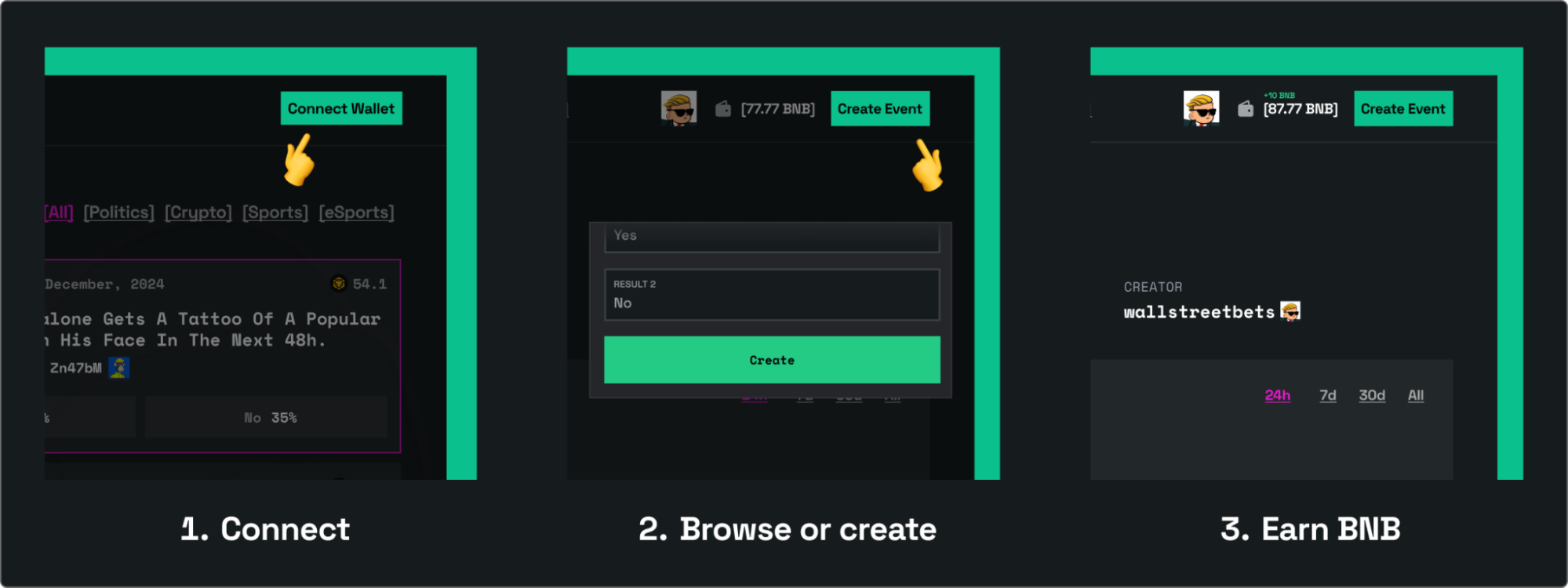

Prediction Markets

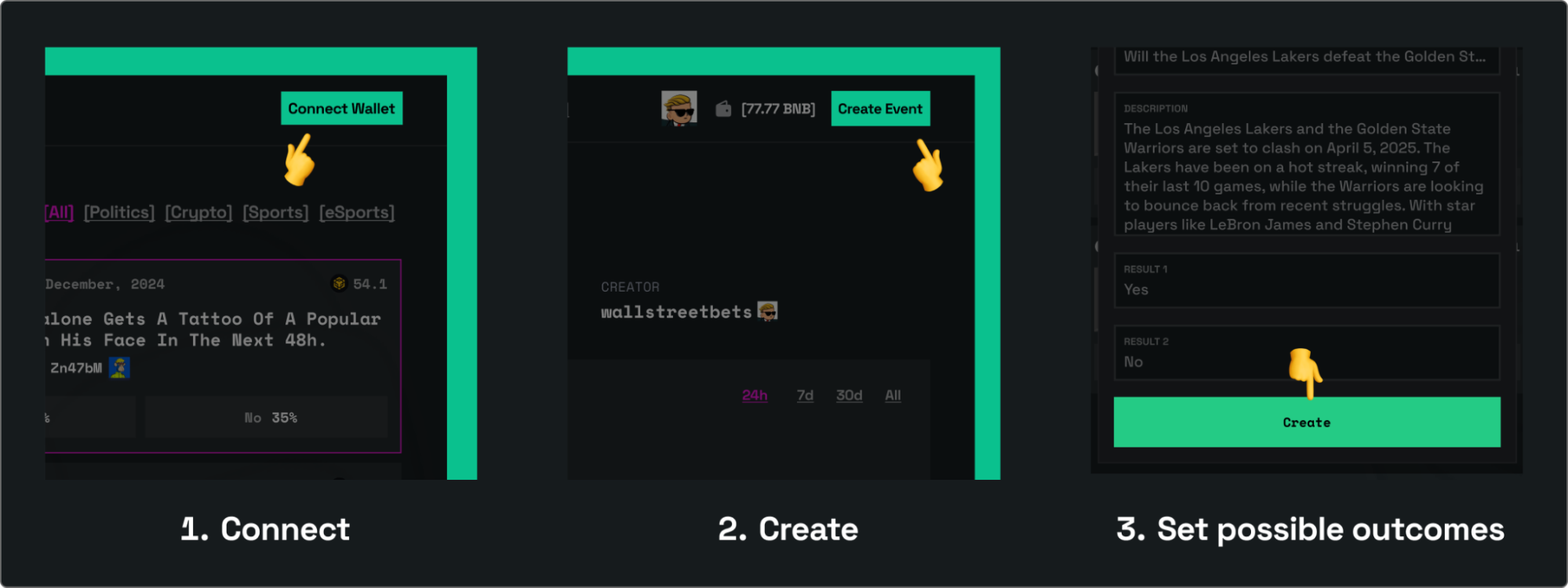

Prediction markets function like a stock exchange for events. You buy and sell shares with other users, betting against peers rather than a house.

How It Works:

- Events are listed as questions with Yes/No or multiple outcomes

- Share prices fluctuate based on supply and demand

- You buy shares from other users who want to sell

- Winning shares pay $1.00; losing shares are worthless

Example: Buy 100 "Yes" shares for "Team A wins" at $0.60 each ($60 total). If Team A wins, you receive $100 (100 shares × $1). Profit = $40.

Key Differences Breakdown

1. How Odds and Pricing Work

Traditional Betting Odds:

- Set by bookmakers using expert algorithms

- Include 5–10% house edge

- Fixed once you place the bet

- Displayed as fractional, decimal, or American odds

Prediction Market Pricing:

- Determined by supply and demand

- No house edge

- Prices fluctuate until the event resolves

- Displayed as share prices ($0.01–$0.99) reflecting probability

Winner: Prediction markets often offer better value due to no house edge.

2. Market Structure and Liquidity

Traditional Betting:

- Guaranteed liquidity; bookmaker always takes your bet

- Instant execution

- Bet size limits

- Professional odds-making ensures availability

Prediction Markets:

- Liquidity depends on other users

- May need to wait for matching trades

- Flexible position sizes

- Market depth varies by event popularity

Winner: Traditional betting for guaranteed execution; prediction markets for potentially better prices.

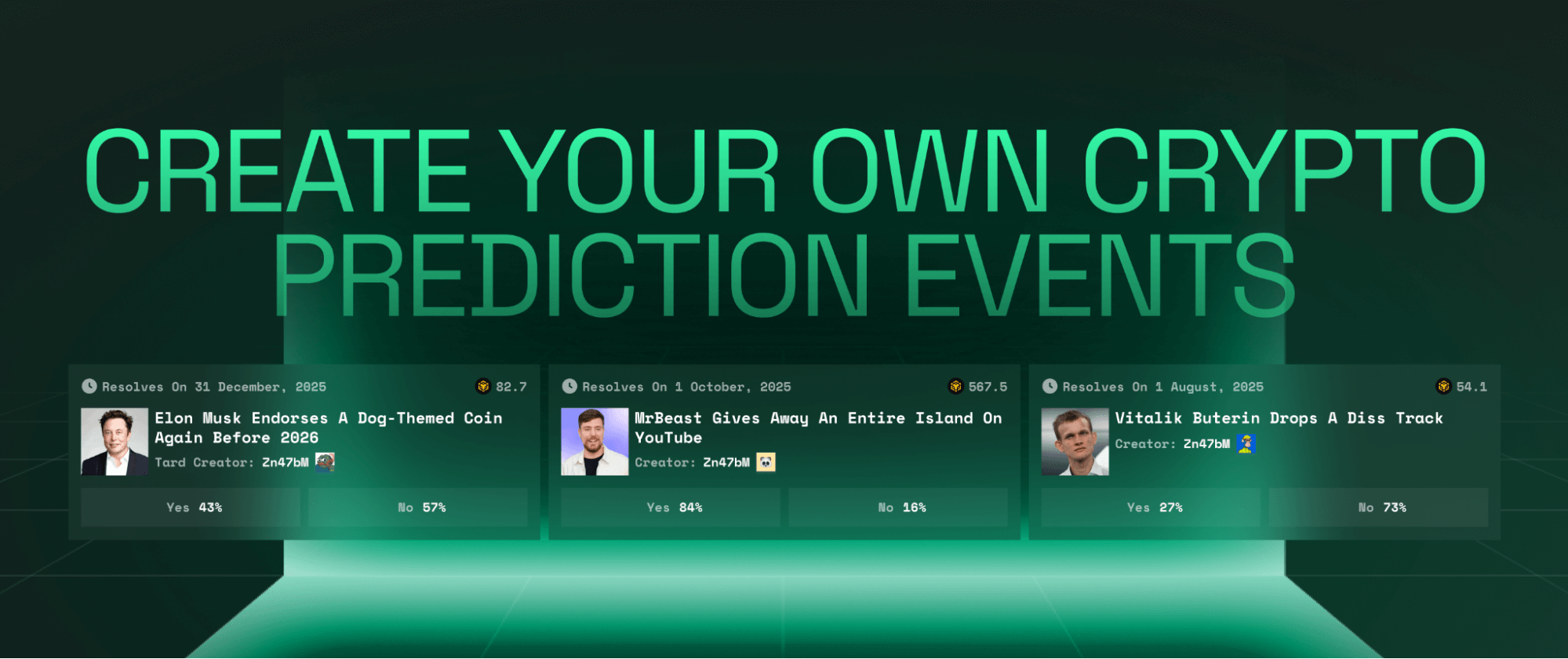

3. Event Coverage and Variety

Traditional Betting:

- Mostly major sports leagues

- Limited entertainment and political events

Prediction Markets:

-

Covers politics, crypto, tech, science, and current events

-

Supports user-created markets

-

Long-term predictions possible

Winner: Prediction markets for variety; traditional betting for sports depth.

4. Regulation and Legal Status

Traditional Betting:

- Heavily regulated

- Licensed operators, consumer protection, clear dispute processes

Prediction Markets:

- Regulatory gray area in many regions

- Limited consumer protections

Winner: Traditional betting for regulatory clarity.

5. User Experience and Interface

Traditional Betting:

-

Familiar interface

-

Polished apps and promotions

-

Robust customer support

Prediction Markets:

-

Learning curve for new users

-

Community-driven support

-

Fewer promotions

Winner: Traditional betting for ease of use; prediction markets for community engagement.

6. Settlement and Payouts

Traditional Betting:

- Instant settlement

- Automated systems

- Multiple payout options

Prediction Markets:

- Settlement can take hours/days

- Manual verification in some cases

- Often crypto-only payouts

Winner: Traditional betting for speed.

7. Fees and Costs

Traditional Betting:

- Hidden in odds (house edge)

- Free deposits/withdrawals

- Predictable costs

Prediction Markets:

- Transaction fees (1–2%)

- Transparent pricing

- Network fees on crypto platforms

Winner: Depends on preference, hidden costs vs transparency.

Detailed Comparison by Category

Sports Betting

Traditional Sportsbooks: ✅ Comprehensive coverage, live betting, instant payouts ❌ Limited exotic markets, house edge

Prediction Markets: ✅ Better odds, unique markets ❌ Lower liquidity, slower settlement

Best For Sports: Traditional betting wins.

Political Betting

Traditional Betting: ✅ Major elections, regulated ❌ Restricted markets Prediction Markets: ✅ Extensive coverage, real-time updates ❌ Regulatory uncertainty

Best For Politics: Prediction markets win.

Cryptocurrency and Tech Events

Traditional Betting: ❌ Limited coverage Prediction Markets: ✅ Full crypto and tech coverage, DeFi events, user-created markets

Best For Crypto/Tech: Prediction markets dominate.

Entertainment and Pop Culture

Traditional Betting: ✅ Major award shows, reality TV ❌ Limited coverage Prediction Markets: ✅ Broad coverage, social trends, niche events ❌ Lower liquidity

Best For Entertainment: Prediction markets edge out traditional betting.

Accuracy and Information Value

Traditional Betting: Expert odds, slower to react, skewed by house edge Prediction Markets: Wisdom of crowds, financial incentives for accuracy, real-time updates Studies show prediction markets consistently outperform traditional polls and expert forecasts for political events.

Cost Comparison Examples

Example 1: Presidential Election

-

Traditional Betting: Bet $100 at +120 odds, profit $120, house edge ~5%

-

Prediction Market: Buy 238 shares at $0.42, win $238, platform fee $2, net profit $136

Prediction market offers 13% better payout

Example 2: Sports Game

-

Traditional Betting: Bet $110 at -110 odds, win $100, house edge ~4.5%

-

Prediction Market: Buy 229 shares at $0.48, win $229, platform fee $2.20, net profit $116.80

Prediction market offers 17% better payout.

Choosing the Right Platform

Choose Traditional Betting If You:

-

Want instant, guaranteed bets

-

Prefer familiar odds formats

-

Bet primarily on mainstream sports

-

Value regulatory protection

-

Want promotions and customer support

Choose Prediction Markets If You:

-

Want politics, crypto, or current events

-

Seek better odds and higher profits

-

Enjoy research and analysis

-

Don’t mind learning new interfaces

-

Prefer transparent fees

-

Are comfortable with crypto payments

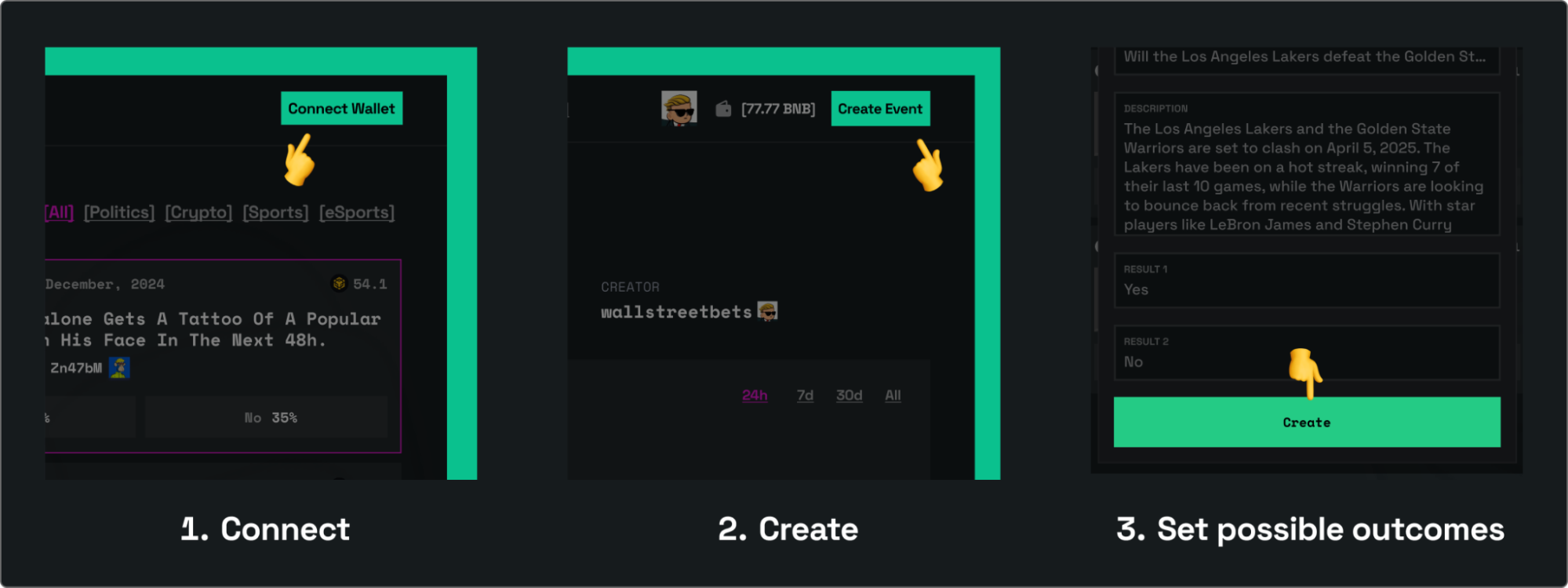

Hybrid Approach

-

Traditional betting for sports

-

Compare odds to maximize value

Platform Recommendations

Best Traditional Betting Platforms:

- FanDuel/DraftKings (US)

- Bet365 (Global)

- William Hill

Best Prediction Market Platforms:

- Kalshi (US Regulated)

- Polymarket (Global)

- Manifold Markets

- Predchain (Global)

Risk Considerations

Traditional Betting Risks: House edge, account restrictions, addiction potential Prediction Market Risks: Liquidity risk, platform risk, regulatory uncertainty, settlement disputes

Tax Implications

Traditional Betting: Winnings taxed as income, clear reporting Prediction Markets: Often treated as gambling or capital gains; track trades carefully; crypto adds complexity

Future Trends

Traditional Betting: Increased legalization, live betting expansion, crypto adoption Prediction Markets: Mainstream adoption, institutional use, regulatory clarity, improved interfaces

Frequently Asked Questions (FAQ)

Which is more profitable?

Prediction markets often offer better odds, but profit depends on your skill, knowledge, and the type of event.

Are prediction markets legal everywhere?

No. The regulatory status varies by country and region. Always check your local laws before participating.

Can I use the same strategies?

Some research methods overlap, but the underlying mechanics differ significantly between the two.

Which is better for beginners?

Traditional betting is more familiar and easier to understand, but some prediction markets offer practice modes for new users.

Which settles bets faster?

Traditional betting usually settles instantly. Prediction markets may take longer, though some platforms offer fast-settling short-term markets.

Are prediction market odds more accurate?

Studies suggest prediction market odds are often more accurate, particularly for political and large-scale public events.

Conclusion

Both prediction markets and traditional betting have unique strengths:

-

Traditional betting: Sports coverage, ease of use, regulatory clarity

-

Prediction markets: Event variety, better odds, accuracy

Recommended approach:

- Start with traditional betting for sports

- Explore prediction markets for politics, crypto, and trending events

- Use both to access the best odds and widest coverage

The prediction market industry is rapidly evolving.

Ready to get started? Explore Predchain today and join the growing community of participants shaping the future with their predictions!