How to Trade Tech Prediction Markets: Product Launches, IPOs & More

TL;DR: Technology prediction markets are platforms where users trade shares based on future tech-related outcomes like IPOs, AI milestones, or crypto prices. The price of each share reflects the probability of that outcome occurring, enabling real-time, crowd-powered forecasts.

Technology prediction markets allow traders to speculate on future outcomes in the tech industry, from AI breakthroughs and product launches to crypto price action and high-profile IPOs.

These markets transform opinions into real-time prices, helping users profit from foresight and analyze the future of innovation.

In this guide, you'll learn:

- What are technology prediction markets?

- How to trade tech IPOs, AI, crypto, and startup outcomes

- Best platforms for tech prediction markets

- Key trends and regions (USA vs Europe)

- Risks, strategies, and legal issues

What Are Technology Prediction Markets?

Technology prediction markets are speculative platforms where users buy and sell shares based on tech-related events:

- Will OpenAI release GPT-5 before Jan 1, 2026?

- Will Stripe go public in 2025?

- Will Bitcoin hit $100K this year?

Each share represents a potential outcome and its price reflects the crowd’s confidence.

These markets combine insights from tech enthusiasts, investors, and insiders to generate probabilistic forecasts, often outperforming polls or analysts.

AI and Cryptocurrency Prediction Markets

AI Prediction Markets

Speculate on the release, regulation, or adoption of AI technologies:

- Will GPT-5 launch by Q1 2026?

- Will Meta open-source its next LLM?

- Will AI-generated songs reach Billboard Top 10?

These markets offer insights into adoption trends and research timelines.

Cryptocurrency Prediction Markets

Bet on Bitcoin, Ethereum, and blockchain trends:

- Will ETH flip BTC in market cap?

- Will Solana reach $500?

- Will a new stablecoin overtake USDT in volume?

Platforms like Predchain let users create custom crypto prediction events with DeFi transparency.

Related: Crypto Price Prediction Markets. How to Predict BTC & ETH

IPO Prediction Markets: Startup Betting Guide

Tech IPO betting involves trading shares based on whether a company will go public — and when.

Common market types:

- "Will Stripe IPO by Dec 31, 2025?"

- "Will SpaceX file S-1 before Q2 2026?"

- "What will Reddit's IPO valuation be at close?"

These markets help surface collective expectations about startups, unicorns, and VC-backed exits.

Case Study:

In 2023, prediction markets surfaced collective expectations about Reddit’s anticipated IPO, reflecting trader speculation on timing and valuation. While exact market prices and timing are not publicly confirmed, these platforms showcased how crowd forecasting can anticipate major tech events. Reddit ultimately went public on March 21, 2024, with shares opening above their IPO price, validating many market participants’ outlooks. This example highlights how technology prediction markets help aggregate insights and signal investor sentiment, even if precise historical market data may be unavailable.

How Do IPO Prediction Markets Work?

- A market is created (YES/NO format)

- Traders buy shares priced from $0.01 to $1.00

- If the event happens, "YES" shares pay $1; otherwise, "NO" shares do

Tech Trend Forecasting: VR, AI, and Blockchain Markets

Markets also cover future adoption, regulation, and milestones:

- "Will 25% of U.S. teens own a VR headset by 2027?"

- "Will the EU pass AI regulations by Q3 2025?"

- "Will a DAO win a court case in 2026?"

These speculative markets offer:

- Research value for analysts

- Risk-adjusted returns for traders

- Real-time tech sentiment tracking

Best Platforms for Tech Prediction Markets

| Platform | Focus Areas | Decentralized? | Token Incentives | Regions |

|---|---|---|---|---|

| Polymarket | Tech, politics, crypto | ✅ | No | Global |

| Predchain | Crypto, tech, AI | ✅ | Earn BNB fees | BNB Chain (Global) |

| Kalshi | Regulated finance & macro | ❌ (U.S. only) | No | USA Only |

| Manifold Markets | Free play & fun markets | ❌ | Play money | Global |

| Insight Prediction | Tech & science focused | ❌ | US-friendly | Global |

Related: Compare Centralized vs Decentralized Prediction Markets

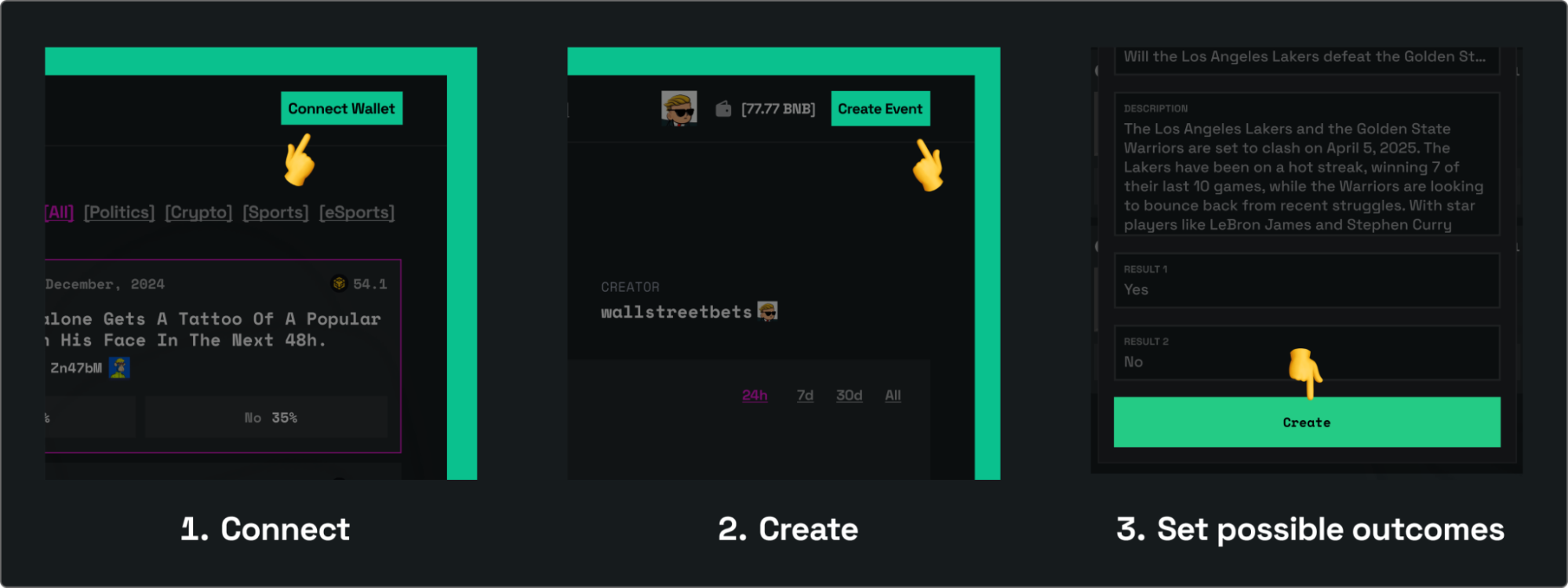

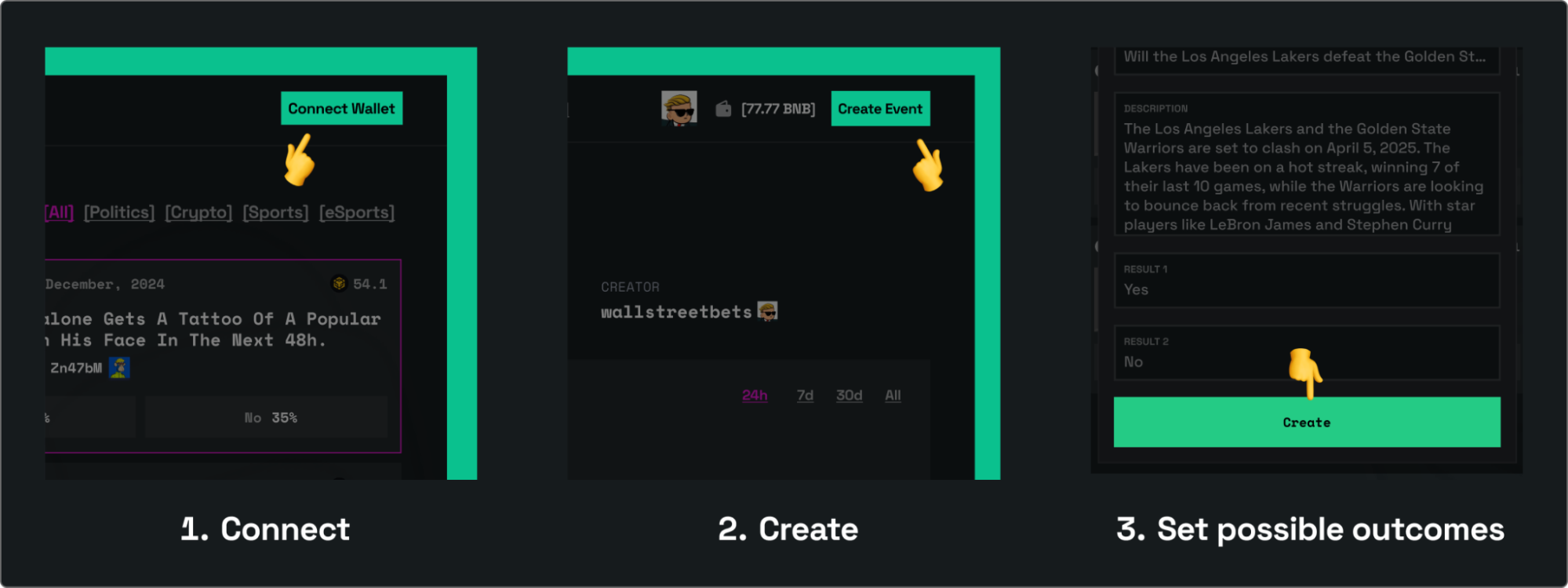

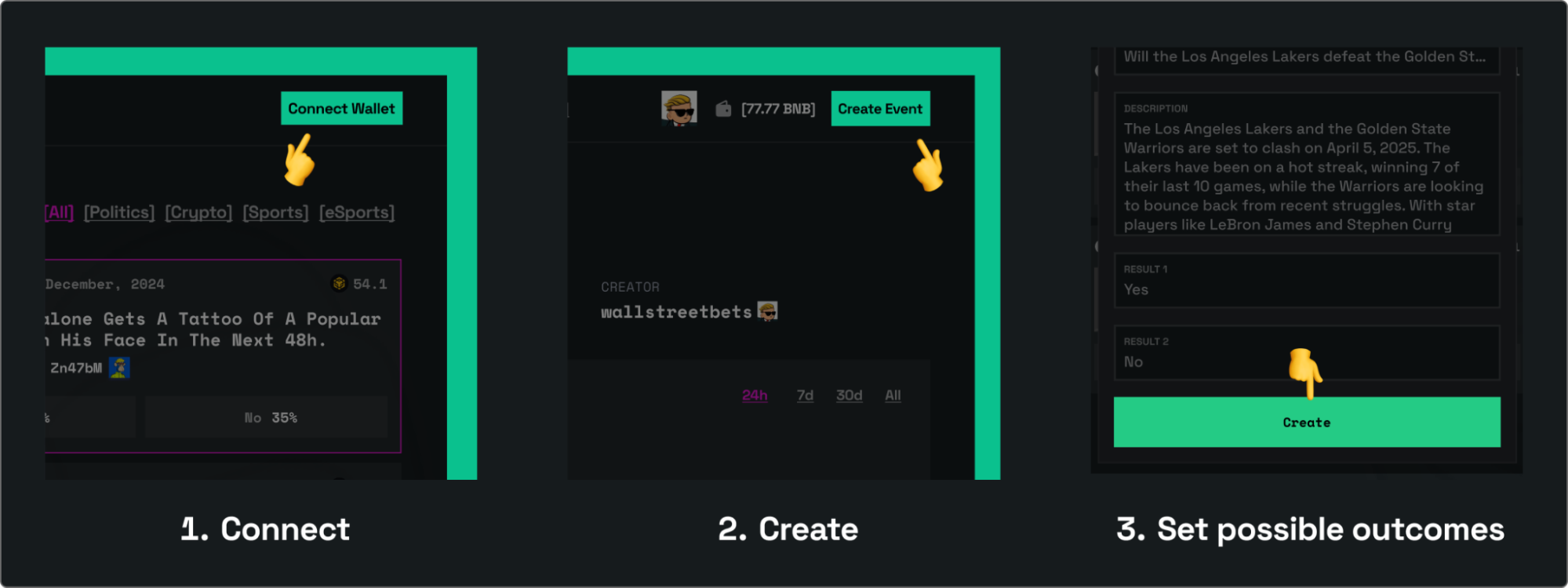

How to Create a Technology Prediction Market

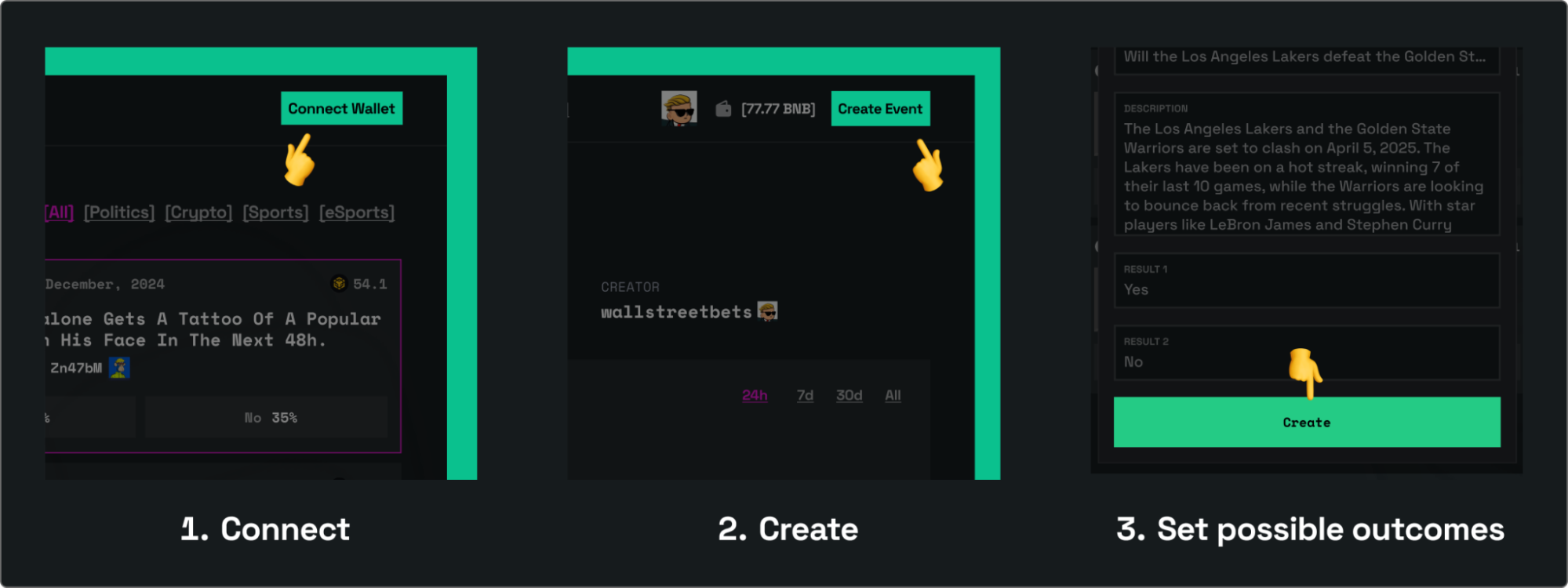

Follow these steps to create your own technology market:

- Go to Predchain and hit “Connect” to link your wallet

- Click “Create Event” and fill in your tech event details (name, description, duration, and category)

- Set possible outcomes for the tech event and click “Create”

Tech Prediction Markets by Region

United States:

- Kalshi is CFTC-regulated but limited to macro markets

- Polymarket blocks U.S. users

- PredictIt has limited tech-related markets

Europe:

- Access to decentralized platforms is generally unrestricted

- Interest in AI/crypto regulation makes EU-focused markets attractive

Asia:

- Rising interest in blockchain prediction platforms

- Regulatory clarity varies by country

Related: What Are Prediction Markets and How Do They Work? A Beginner’s Guide?

Risks and Regulation

- U.S. regulation limits availability of real-money tech markets

- Decentralized markets are global, but users should check local laws

- Liquidity in niche tech markets can be low

- Manipulation risk: small markets can be influenced by whales

Frequently Asked Questions

How accurate are IPO prediction markets?

Many outperform analyst estimates, especially when events are near-term and public data is available. Crowd consensus can price timing and sentiment more quickly than legacy institutions.

Can you make money trading AI prediction markets?

Yes, especially when you're early to sentiment shifts. Example: GPT-4 release dates were accurately predicted weeks ahead by market movements.

Are cryptocurrency prediction markets legal?

It depends on the platform and your location. Platforms like Kalshi are legal in the U.S., while decentralized markets like Predchain operate globally but may face restrictions in certain regions.

What tech companies might IPO in 2025?

Stripe, SpaceX, OpenAI (unlikely), Databricks, Chime, and Reddit are commonly traded IPO predictions across multiple platforms.

Conclusion

Tech prediction markets offer a powerful tool for forecasting innovation. Whether you’re betting on the next big IPO, tracking AI breakthroughs, or speculating on blockchain milestones — these markets turn foresight into financial opportunity.

Explore Predchain today to create your first tech prediction market event and start earning BNB from trading fees!