Political Prediction Markets: How to Predict Elections & Policies

Quick Answer

Political prediction markets allow traders to buy and sell shares tied to the outcome of elections, legislation, or government decisions. These markets leverage the wisdom of crowds, financial incentives, and real-time information to produce highly accurate forecasts, often outperforming traditional polls and expert predictions. Platforms like Predchain make it easy to participate, create markets, and earn rewards from political event trading.

What Are Political Prediction Markets?

Political prediction markets, also called electoral forecasting platforms or legislative prediction platforms, are online markets where participants speculate on the outcome of political events, such as:

- Presidential or parliamentary elections

- Policy decisions and regulatory changes

- Legislative votes and government appointments

Participants buy "Yes" or "No" shares for a particular outcome, and the price reflects the collective probability that the event will occur. These platforms combine voter sentiment, campaign developments, political volatility, and historical trends to deliver a continuously updating forecast.

Learn more about creating your own markets in How to Create Custom Prediction Markets

How Political Prediction Markets Work

- Market Creation: Anyone can propose an event, e.g., “Will Candidate A win the 2026 Senate election?”

- Trading Shares: Traders buy and sell shares based on their belief in the outcome, using real money or cryptocurrency.

- Price Signals: The market price represents the estimated probability of the event occurring, dynamically adjusting as new information emerges.

- Settlement: After the outcome is resolved, traders with correct predictions earn payouts proportional to their shares.

For a deeper dive, see Step-by-Step Guide to Political Event Trading.

Benefits of Political Prediction Markets

Political prediction markets offer several advantages over traditional forecasting tools:

- Accuracy: Historical studies show that markets often outperform polls and expert forecasts, especially in fast-changing or complex political environments.

- Real-Time Updates: Markets react immediately to new developments like debates, scandals, or last-minute campaign events.

- Diverse Perspectives: By aggregating opinions from multiple participants, markets reduce individual biases present in surveys or expert predictions.

- Monetary Incentives: Traders have skin in the game, motivating careful analysis of voter sentiment, campaign finance reports, and legislative trends.

Example: In the 2020 U.S. presidential election, political prediction markets priced Joe Biden’s chances higher than many traditional polls weeks before Election Day, reflecting both voter sentiment and real-time campaign developments.

Related: Why Prediction Markets Often Beat Polls and Experts

Risks and Considerations

- Regulatory Compliance: Laws vary by country. Some jurisdictions restrict political betting, so always check local regulations before participating.

- Market Liquidity: Low trading volume can result in price volatility and less reliable probability estimates.

- Information Accuracy: Markets are only as good as the information fed into them. Misleading news or misinterpreted data can temporarily distort prices.

- Minimum Investment: While platforms like Predchain allow minimal capital entry, trading with very small stakes may limit learning potential and earnings.

Getting Started: Political Event Trading Tips

- Start Small: Begin with a few dollars or crypto to understand market mechanics without high risk.

- Cross-Reference Data: Combine insights from polls, news, and prediction markets to refine your probability estimates.

- Follow Campaign Developments: Track debates, policy announcements, campaign finance, and polling trends.

- Focus on Active Markets: Choose events with high liquidity and trading volume for more reliable price signals.

Check out: Beginner's Guide to Trading Prediction Markets

How to Create a Political Prediction Market

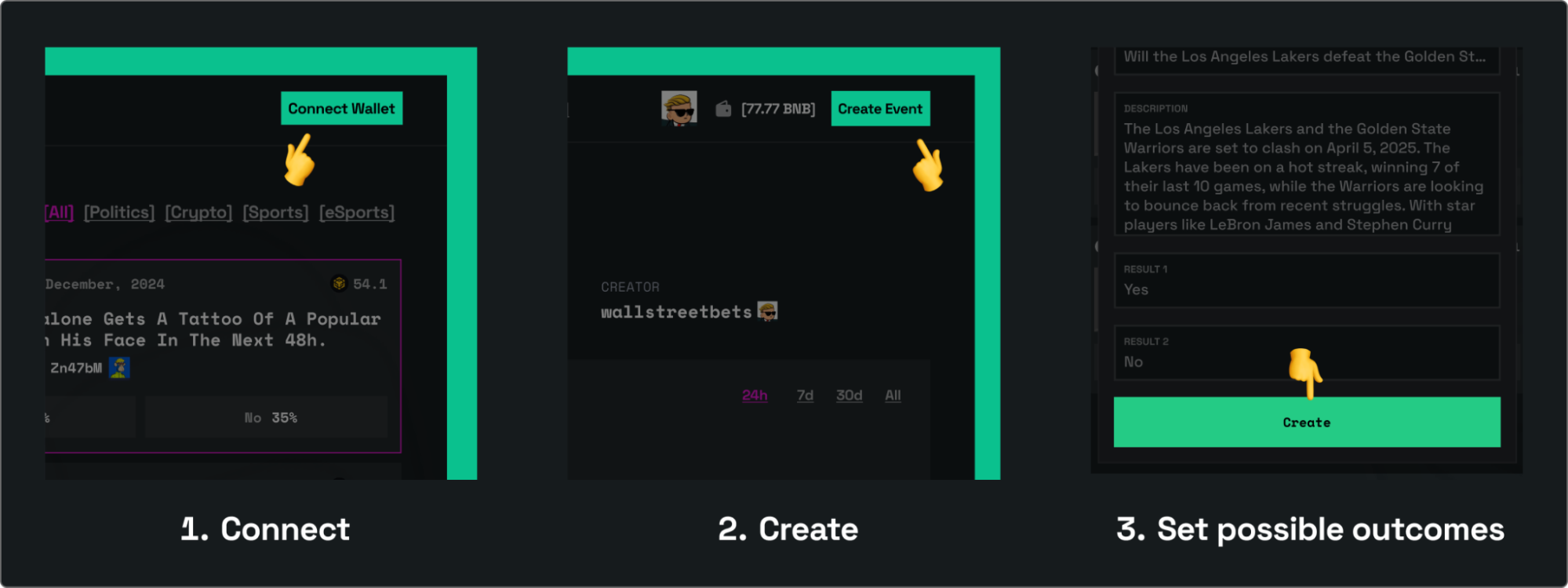

Follow these steps to create your own political market:

- Go to Predchain and hit “Connect” to link your wallet

- Click “Create Event” and fill in your political event details (name, description, duration, and category)

- Set possible outcomes for the political event and click “Create”

Historical Examples of Successful Political Predictions

- Brexit Referendum 2016: Prediction markets correctly indicated a nearly 50/50 split before polls lagged in reflecting public sentiment.

- 2012 U.S. Presidential Election: Markets like Intrade showed Barack Obama’s chances higher than most traditional polling models, predicting the outcome more accurately.

- 2014 Indian General Elections: Localized political betting markets in India captured voter sentiment faster than national polls.

FAQs

How accurate are prediction market prices?

Prediction markets are often more accurate than polls or expert forecasts because they aggregate information from many participants with strong incentives to predict correctly. Platforms like Predchain and Polymarket offer real-time probability updates as new information arrives.

Why are prediction markets better than polls for fast-moving events?

Prediction markets continuously update in real-time, reflecting breaking news, sentiment shifts, or unexpected developments, while polls are periodic and cannot capture rapid changes.

Can experts outperform prediction markets?

Experts can be valuable, but prediction markets combine multiple expert and non-expert views, weighted by financial commitment, often resulting in higher accuracy.

Conclusion

Political prediction markets are powerful tools for election forecasting, government policy predictions, and legislative tracking. They leverage collective intelligence, financial incentives, and real-time updates to provide accurate and dynamic forecasts.

By participating in political event trading, monitoring liquidity, and cross-referencing traditional data sources, traders, analysts, and enthusiasts can gain actionable insights and potentially earn from their predictions.

Explore decentralized platforms like Predchain, start trading small, and follow political developments to enhance your forecasting skills.