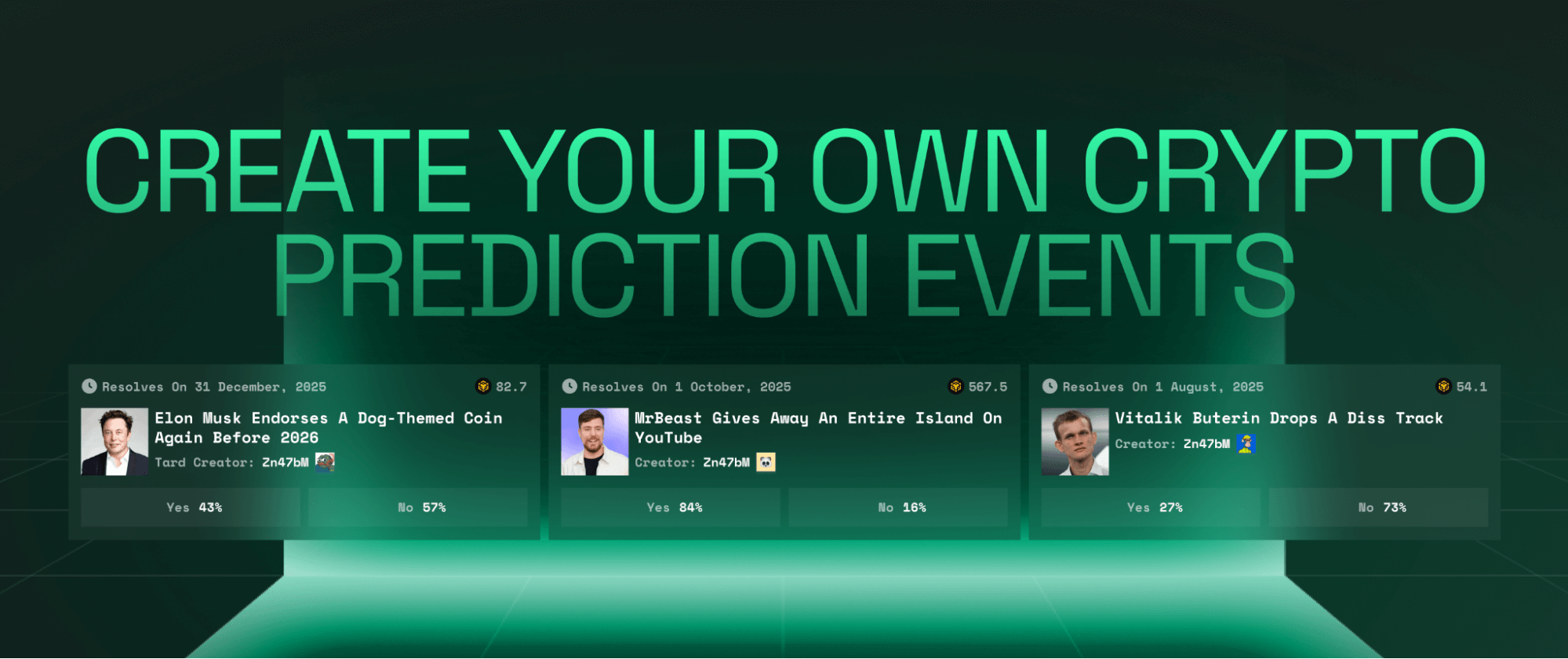

How to Create Your Own Crypto Prediction Events (A Quick Guide)

What Are Crypto Prediction Events?

Crypto prediction events let users trade on the outcome of future events, like Bitcoin price milestones or Ethereum upgrades, using decentralized platforms such as Predchain or Polymarket.

Instead of existing as standalone websites, these are individual markets within larger platforms that also feature predictions on politics, sports, and more.

On these platforms, users buy and sell “Yes” or “No” shares tied to possible outcomes of crypto events (for example, “Will Bitcoin close above $100,000 on December 31, 2025?”). The price of each share shows what the market thinks the odds are for that outcome.

All trades are secured by blockchain technology and smart contracts, making transactions transparent, secure, and automatic. When the event ends, decentralized oracles verify the result and settle the market without human bias.

Key Features of Crypto Prediction Events on Platforms

- Event-focused: Specific to questions about crypto (e.g., BTC > $80K).

- Decentralized and transparent: Trades and outcomes are recorded on-chain.

- Market-driven odds: Share prices reflect real-time user sentiment.

- Automated resolution: Oracles resolve events and smart contracts handle payouts.

How Crypto Prediction Events Differ from Regular Trading

- Binary Outcomes vs. Price Speculation: Prediction markets offer set outcomes (yes/no, this/that), unlike trading which deals with continuous price movement.

- Fixed Odds vs. Variable Pricing: Odds are determined by market participation, not supply/demand volatility.

- Risk Profile: Lower leverage and more defined risk make these markets attractive to a broader audience.

How to Get Started with Crypto Prediction Events

Crypto prediction events allow users to speculate on the outcome of cryptocurrency-related events using decentralized platforms. To participate effectively and safely, follow these essential steps:

Step 1: Choose Your Platform

Compare decentralized platforms like Predchain, Polymarket or others based on:

- Trading fees and liquidity

- Level of decentralization and transparency

- Variety of available crypto-related markets (e.g., Bitcoin, Ethereum, altcoins, DeFi, regulatory events)

- Regulatory compliance and regional access

Step 2: Fund Your Account

Set up a compatible crypto wallet (such as MetaMask) and fund it with stablecoins like USDC, BNB or platform-specific tokens. Most prediction markets require you to connect your wallet directly for seamless, non-custodial trading.

Step 3: Conduct Research and Analysis

Use on-chain analytics, crypto news, and trading tools to inform your predictions. Stay updated on market cycles, regulatory changes, and major crypto events to improve your odds.

Step 4: Place Your First Trade

Select a crypto prediction event (for example, “Will Bitcoin close above $1000,000 on December 31, 2025?”), decide your position size, and confirm your trade through your wallet. Prices reflect the crowd’s consensus probability, and you can typically buy or sell shares at any time before resolution.

✅ Tip: Diversify across multiple markets and avoid going all-in on a single event.

Once you're comfortable trading, you might want to create your own prediction markets. Custom events where others can trade and you earn BNB from trading fees.

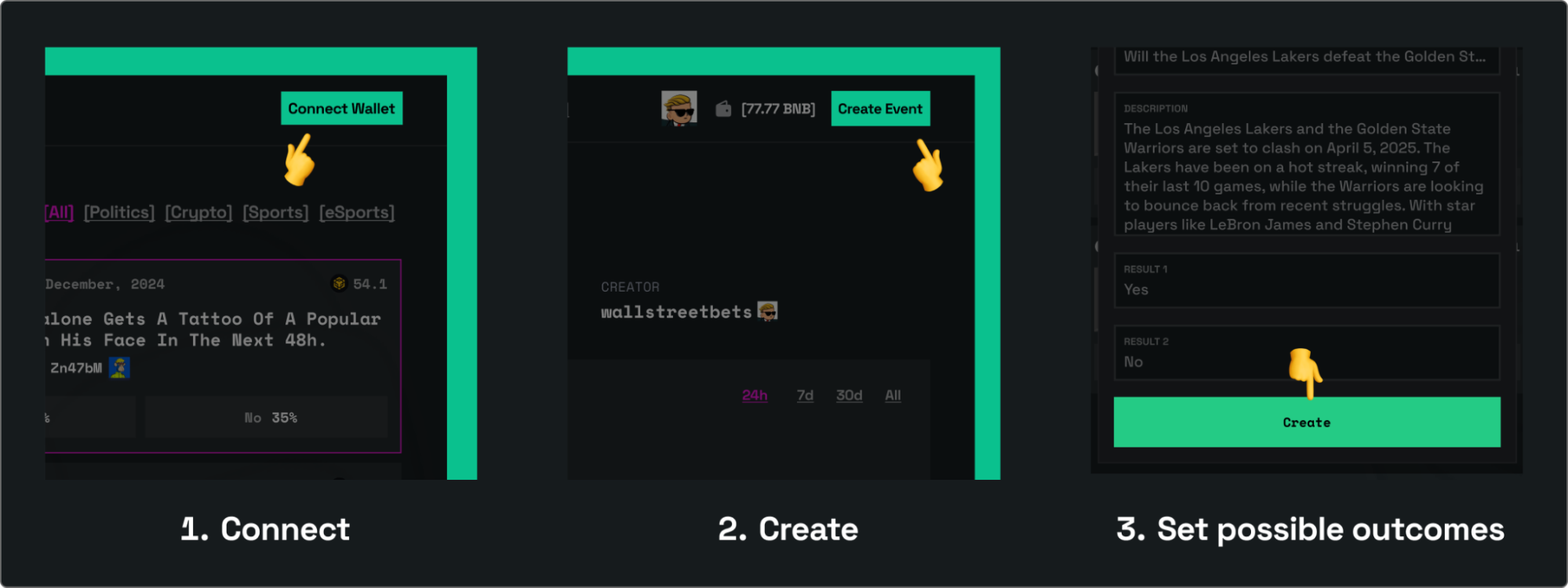

How to Create a Crypto Prediction Event

Here’s a step-by-step guide on how to create your own crypto predictions using Predchain:

-

Connect Your Wallet: Visit Predchain and link your crypto wallet (MetaMask or similar).

-

Create a New Event: Click “Create Event” and fill in the event name, description, duration, and choose the Crypto category.

-

Define Outcomes & Launch: Define the possible outcomes (e.g., Yes/No), then click “Create” to publish it on-chain.

Types of Crypto Prediction Events

On decentralized platforms such as Predchain, users can participate in specialized markets focused on major crypto events and trends. The main types include:

- Bitcoin Price Prediction Markets: Predict BTC milestones, halving cycles, or ETF approvals.

- Ethereum Prediction Markets: Predict outcomes related to upgrades (e.g., Dencun), gas fees, or L2 adoption.

- Altcoin Prediction Markets: Market movements, token listings, or ecosystem growth (SOL, AVAX, DOGE).

- DeFi Protocol Predictions: TVL growth, APY changes, or project success metrics.

- Crypto Regulatory Prediction Markets: Will the SEC approve an Ethereum ETF by [date]?

- Blockchain Event Predictions: Hard forks, bridge hacks, difficulty changes, etc.

Strategies for Crypto Prediction Event Success

Whether you're new or experienced, these core strategies can improve your decision-making and boost your chances of success.

Beginner Strategies

- Event-Based Trading: React to key catalysts like Bitcoin halvings, ETF announcements, or exchange listings.

- Technical Analysis Application: Apply TA for price-level-based markets (e.g., BTC > $80K).

- Fundamental Analysis: Track development activity, tokenomics, and network metrics.

- Sentiment Analysis: Use social media trends, Fear & Greed Index, and influencer sentiment to anticipate crowd behavior.

Advanced Strategies

For experienced traders, these advanced strategies can help maximize returns and minimize risk:

- Arbitrage Opportunities: Take advantage of pricing differences between platforms or timeframes.

- Hedging Crypto Positions: Use prediction markets to offset risks from spot holdings or DeFi LPs.

- Market Making: Provide liquidity in low-volume markets to earn fees.

Risks and Considerations

Before diving into prediction markets, it's important to understand the potential risks and challenges. Here's what you should consider:

- Market Risks: Crypto volatility can skew odds or cause sudden reversals.

- Platform Risks: Smart contract vulnerabilities and liquidity issues.

- Legal and Tax Implications: Check your local laws. Profits may be taxable in your jurisdiction.

Tools and Resources for Crypto Prediction Events

To succeed in crypto prediction markets, leverage a combination of research tools, trading platforms, and educational resources.

Research Tools

-

Dune Analytics: Customizable dashboards for on-chain data, enabling users to analyze smart contract activity and market trends.

-

CoinGecko / CoinMarketCap: Leading crypto data aggregators providing real-time prices, market caps, trading volumes, and token analytics for thousands of cryptocurrencies.

-

Messari: Advanced analytics platform offering in-depth research, market intelligence, and professional-grade screening tools for crypto assets.

-

Santiment: Tracks social sentiment, on-chain activity, and developer metrics for over 2,000 projects, helping identify trends and market shifts.

-

Glassnode: Provides on-chain analytics, including wallet activity, network health, and market indicators for Bitcoin, Ethereum, and altcoins.

-

CryptoQuant: Real-time alerts and comprehensive on-chain data for major cryptocurrencies, including exchange flows, miner activity, and whale movements.

Trading Tools

-

DeBank: Portfolio tracker and DeFi analytics tool, allowing users to monitor assets, yield strategies, and wallet performance across multiple blockchains.

-

Zapper: Multi-chain dashboard for tracking DeFi positions, managing assets, and visualizing portfolio performance.

-

TradingView: Industry-standard charting platform with technical analysis indicators, customizable alerts, and a large crypto community.

Educational Resources

-

Prediction Market Discord Communities: Join active Discord servers dedicated to prediction markets for real-time discussion, market insights, and strategy sharing.

-

YouTube Explainers: Channels and playlists focused on prediction market tutorials, platform walkthroughs, and market analysis.

-

Prediction Market Docs: Comprehensive guides and FAQs covering platform mechanics, market creation, and trading strategies on Predchain Docs.

Create Your Crypto Prediction Event Now. Predict the Future.